Mrs. roberts has original medicare and would like to enroll – Mrs. Roberts, like many seniors, faces the daunting task of navigating the complex world of Medicare enrollment. With Original Medicare as her current coverage, she seeks to optimize her healthcare options. Join us as we explore her path to enrollment, examining the intricacies of Original Medicare and the various supplementary plans available to her.

As we delve into the nuances of Medicare coverage, we’ll provide a comprehensive understanding of eligibility requirements, enrollment procedures, and the benefits associated with each plan. Our aim is to empower Mrs. Roberts and other individuals with the knowledge they need to make informed decisions about their healthcare.

Medicare Coverage

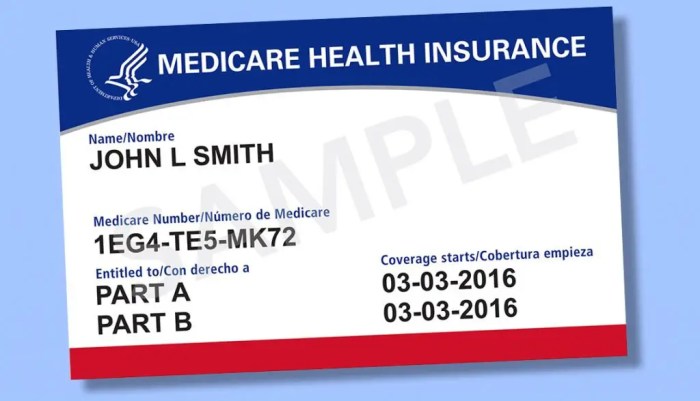

Medicare is a health insurance program for people aged 65 and older, younger people with certain disabilities, and people with End-Stage Renal Disease (ESRD). There are two main types of Medicare coverage:

Original Medicare, Mrs. roberts has original medicare and would like to enroll

Original Medicare is the traditional Medicare program. It includes Part A (hospital insurance) and Part B (medical insurance). Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care. Part B covers doctor visits, outpatient care, durable medical equipment, and some preventive services.

Medicare Advantage Plans

Medicare Advantage Plans are offered by private insurance companies that contract with Medicare. These plans provide all of the benefits of Original Medicare, plus additional benefits, such as prescription drug coverage, dental coverage, and vision coverage. Medicare Advantage Plans typically have lower out-of-pocket costs than Original Medicare, but they may also have more restrictions on where you can get care.

Original Medicare Enrollment

To be eligible for Original Medicare, you must be:

- Aged 65 or older

- A younger person with a disability that has lasted or is expected to last for at least 12 months

- A person with ESRD

You can enroll in Original Medicare during your Initial Enrollment Period (IEP). Your IEP begins three months before the month you turn 65 and ends three months after the month you turn 65. You can also enroll during the General Enrollment Period, which runs from January 1 to March 31 each year.

If you miss your IEP or the General Enrollment Period, you may be able to enroll during a Special Enrollment Period.

Medicare Supplement Plans: Mrs. Roberts Has Original Medicare And Would Like To Enroll

Medicare Supplement Plans are offered by private insurance companies that contract with Medicare. These plans help to cover the out-of-pocket costs of Original Medicare, such as deductibles, copayments, and coinsurance. There are different types of Medicare Supplement Plans available, each with its own set of benefits and costs.

Types of Medicare Supplement Plans

- Plan A: Covers the Medicare Part A deductible and coinsurance for hospital stays.

- Plan B: Covers the Medicare Part A deductible and coinsurance for hospital stays, and the Medicare Part B deductible and coinsurance for medical expenses.

- Plan C: Covers the Medicare Part A deductible and coinsurance for hospital stays, the Medicare Part B deductible and coinsurance for medical expenses, and the Medicare Part B excess charges.

- Plan D: Covers the Medicare Part A deductible and coinsurance for hospital stays, the Medicare Part B deductible and coinsurance for medical expenses, the Medicare Part B excess charges, and the Medicare Part A skilled nursing facility coinsurance.

- Plan F: Covers the Medicare Part A deductible and coinsurance for hospital stays, the Medicare Part B deductible and coinsurance for medical expenses, the Medicare Part B excess charges, the Medicare Part A skilled nursing facility coinsurance, and the Medicare Part A hospice coinsurance.

Medicare Part D Prescription Drug Plans

Medicare Part D Prescription Drug Plans are offered by private insurance companies that contract with Medicare. These plans help to cover the cost of prescription drugs. There are different types of Medicare Part D Prescription Drug Plans available, each with its own set of benefits and costs.

Types of Medicare Part D Prescription Drug Plans

- Standard Part D Plans: These plans cover a wide range of prescription drugs, but they may have higher out-of-pocket costs than other types of plans.

- Preferred Part D Plans: These plans offer a smaller network of pharmacies than Standard Part D Plans, but they may have lower out-of-pocket costs.

- Medicare Advantage Prescription Drug Plans: These plans combine Medicare Part D coverage with Medicare Advantage coverage. They may have lower out-of-pocket costs than other types of plans, but they may also have more restrictions on where you can get care.

Medicare Advantage Plans

Medicare Advantage Plans are offered by private insurance companies that contract with Medicare. These plans provide all of the benefits of Original Medicare, plus additional benefits, such as prescription drug coverage, dental coverage, and vision coverage. Medicare Advantage Plans typically have lower out-of-pocket costs than Original Medicare, but they may also have more restrictions on where you can get care.

Types of Medicare Advantage Plans

- Health Maintenance Organizations (HMOs): HMOs are the most common type of Medicare Advantage Plan. They offer a wide range of benefits, but you must stay within their network of providers.

- Preferred Provider Organizations (PPOs): PPOs offer a wider network of providers than HMOs, but you may have to pay more for out-of-network care.

- Private Fee-for-Service (PFFS) Plans: PFFS plans allow you to see any provider that accepts Medicare, but you may have to pay more for out-of-network care.

- Special Needs Plans (SNPs): SNPs are designed for people with specific health conditions, such as diabetes or heart disease.

Long-Term Care Insurance

Long-Term Care Insurance is a type of insurance that helps to cover the cost of long-term care services, such as nursing home care, assisted living care, and home health care. Long-Term Care Insurance can help to protect your assets from the high cost of long-term care.

Benefits of Long-Term Care Insurance

- Helps to cover the cost of long-term care services

- Protects your assets from the high cost of long-term care

- Provides peace of mind knowing that you will be able to afford the care you need

Popular Questions

What are the eligibility requirements for Original Medicare?

Individuals aged 65 or older, or those with certain disabilities or end-stage renal disease, are eligible for Original Medicare.

How can I enroll in Original Medicare?

Enrollment can be completed through the Social Security Administration or online at www.ssa.gov.

What are the benefits of Medicare Supplement plans?

Medicare Supplement plans help cover out-of-pocket costs not covered by Original Medicare, such as deductibles, copayments, and coinsurance.